What's wrong with this quote made by Ranji Nagaswami of Alliance Bernstein?

What's wrong with this quote made by Ranji Nagaswami of Alliance Bernstein?The whole job here is to identify a group of asset classes that have as low correlations as you can possibly get, so that when something is not working, something else always is. By pulling together these negatively correlating assets you actually improve the risk-return tradeoffs. You can get above the so-called efficient frontier. The efficient frontier itself gets most people pretty close to a good solution, but we think being a little bit more thoughtful by style, geography, and capitalization can get you above the efficient frontier. That'’s our goal, right?As Robin Williams said in Dead Poet's Society, "BZZZZ! Wrong. You're an Amoeba. Thanks for Playing".

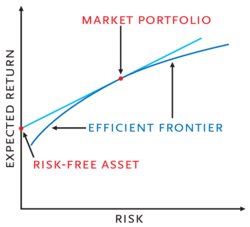

If you mapped out all possible combinations of assets and picked the ones that give you the lowest possible risk (i.e. standard deviation in returns) for a given return (or alternately, the highest return for a given level of risk), you'd have the efficient frontier. The picture above from Wikipedia illustrates what such graph would look like.

The curved line (labeled "Efficient Frontier") is actually the set of minimum variance combinations if if you didn't have a risk free asset as one of your investment choices. By definition, these are the BEST risk-return combinations available among all risky assets.

In addition, if you had a risk-free asset available as one of your investment choices, you could create an even better combination of assets than the "no risk-free asset" efficient frontier. By combining the risk-free asset with the right combination of risky assets (the "market portfolio), you can create a better combination of assets from a risk-return perspective. This is demonstrated by the blue line residing above the curved one. By convention, this straight line is typically referred to as the "Capital Market Line". In effect, it's the "Efficient Frontier" with a risk-free asset as one of the investment choices.

So the bottom line is that, by definition, you can't get above the efficient frontier. If "you can get above the so-called efficient frontier", it isn't the efficient frontier.

Or, as Inigo Montoya would have said, "You keep using that word. I do not think it means what you think it does".

HT: ETF Investor

No comments:

Post a Comment