The finance classroom meets the outside world (and vice-versa). Back away slowly from the computer with your hands up and your mind open, and with luck nobody gets hurt.

Wednesday, March 29, 2006

Yak Shaving Razor #45 (from The Evangelical Outpos)t:

Tuesday, March 28, 2006

Insider Trading By Lawmakers (via WSJ)

Amid broad congressional concern about ethics scandals, some lawmakers are poised to expand the battle for reform: They want to enact legislation that would prohibit members of Congress and their aides from trading stocks based on non-public information gathered on Capitol Hill.Read the whole thing here (online subscription required).Two Democrat lawmakers plan to introduce today a bill that would block trading on such inside information. Current securities law and congressional ethics rules don't prohibit lawmakers or their staff members from buying and selling securities based on information learned in the halls of Congress.

It isn't clear yet what kind of support the bill will garner from Republicans. But its prospects are enhanced by the current charged environment in Congress; lawmakers from both parties in both houses have placed a high priority on passing ethics and lobbying-reform legislation. Such legislation would provide a vehicle to which proponents could attach a measure on stock trades. In addition to banning trading on inside information, the proposal would require that lawmakers and their top aides disclose within 30 days any stock trades. Congressional rules now require lawmakers to disclose their trades once a year.

This is one of the few cases where I'd be more in favor of additional regulation than not, but I don't think it goes far enough. I don't have a problem with legislative "insiders" trading on inside information. But, I think they should be held to the same standard as corporate insiders - make them report their trades within a couple of days. In addition, I think they should make the reports of trading available online so that they become public much sooner. After all, it would provide valuable information that would make markets more efficient.

There is some evidence that legislators benefit from inside information, and I'm surprised the Journal didn't mention it (they're usually pretty good at these things). Cheng, Boyd and Ziobrowski in their 2004 Journal of Financial and Quantitative Analysis article "Abnormal Returns From the Common Stock Investments of the U.S. Senate" found that

...a portfolio that mimics the purchases of U.S. Senators beats the market by 85 basis points per month, while a portfolio that mimics the sales of Senators lags the market by 12 basis points per month. The large difference in the returns of stocks bought and sold (nearly one percentage point per month) is economically large and reliably positive.

Update: Larry Ribstein has some good analysis on the matter here.

Monday, March 27, 2006

This Week's Carnival of Personal Finance

As usual, Searchlight Crusade has some great loan-related information. This time he breaks down the inner working of Joint LoansThat's it for this week. As always, look around. There might be many other articles that I didn't care for that could hit your spot just fine. Tastes, situations, and backgrounds differ.

Dave at Pacesetter Mortgage Blog continues his series on how best to finance home improvements. He shows how a first mortgage loan sometimes beats a second or a home equity line of credit in The #1 Way to Finance a Home Improvement

In the third highlighted post on borrowing, Mighty Bargain Hunter discusses Creative Mortgages, Part 1

A Financial Revolution looks at How Many Stocks Are Needed To Reduce Risk. He's right - not that many if they're in different industries.

Don't Mess With Taxes discusses the recent decision to outsource the collection role of the IRS to private bill collectors in IRS and debt collectors, a partnership made in … (hint - it ain't heaven)

Can Individual Investors Beat the Market? (by Coval, Hirshleifer, & Shumway)

You can download the article off SSRN here.We document strong persistence in the performance of trades of individual investors. The correlation of the risk-adjusted performance of an individual across sample periods is about 10 percent. Investors classified in the top performance decile in the first half of our sample subsequently outperform those in the bottom decile by about 8 percent per year. Strategies long in firms purchased by previously successful investors and short in firms purchased by previously unsuccessful investors earn abnormal returns of 5 basis points per day. These returns are not confined to small stocks nor to stocks in which the investors are likely to have inside information. Our results suggest that skillful individual investors exploit market inefficiencies to earn abnormal profits, above and beyond any profits available from well-known strategies based upon size, value, or momentum.

Sunday, March 26, 2006

UConn Gets Beat By George Mason

Enjoy this time, lads - you'll talk about this tournament to your grand children someday (and deservedly so).

It seems so unfair - first economic bloggery, now basketball...

This Week's Carnival Of The Capitalists

43 Folders pulls out the best from David Allen’s book Getting Things Done Best of Getting Things Done. Some good pieces there.There are lots of other posts in this week's Carnival this time, however, the host has been more selective), so look around a bit.

In a post I blogged about a while back, Steve Pavlina tells us How to Become an Early Riser. Hmm - I need to get back to getting up earlier. Time to re-read this.

Saturday, March 25, 2006

WSJ Interview of Thomas Sowell

So, I greatly enjoyed today's Wall Street Journal interview of Sowell. Not surprisingly (since he's 76), he's refreshingly old school. He makes a critical distinction between how he presents his views within the classroom vs. without (emphasis mine):

Mr. Sowell may be an unabashed free-market adherent, but he's proud to say that Professor Sowell left his personal views out of the classroom. In his 2000 memoir, "A Personal Odyssey," he relates an episode in which some students approached him after taking his graduate seminar on Marxian theory. They expressed appreciation for the course but added, "We still don't know what your opinion is on Marxism." He took it as an unintended compliment."My job was to teach them economics, not teach them what I happen to believe," says Mr. Sowell, who adds that efforts by some today to counterbalance the prevailing liberalism in academia with more right-wing instructors is not only an exercise in futility but a disservice to students. "Even if you succeed in propagandizing the students while they're students, it doesn't tell you much [about how they'll turn out]. I suspect that over half [of the conservatives at the Hoover Institution] were on the left in their 20s. More important, though, let's assume for the sake of argument that, whatever you're propagandizing them with on the left or right, every conclusion you teach them is correct. It's only a matter of time before all those conclusions are obsolete because entirely different issues are going to arise over the lifetimes of these students. And so, if you haven't taught them how to weigh one argument against another, you haven't taught them anything."

Read the whole thing here.

Update: Welcome to all the readers from Brad Delong's blog. Look around a bit and leave some comments before you click onto the next site. And thanks for the mention, Dr. Delong. The traffic is most appreciated.

Friday, March 24, 2006

S&P Unveils Housing Indexes (via the WSJ)

As one example, take the housing market. It's a multi-billion dollar industry, and the risks associated with it affect both individuals (i.e. buyers and sellers) and industry players like construction firms, architects, Home Depot, etc...

However, until recently, there was no good way to manage these risks. Now there is. According to yesterday's Wall Street Journal:

Standard & Poor's, a unit of McGraw-Hill Cos., is rolling out 10 indexes that will track housing prices in various regions of the U.S., as well as a composite index. The indexes, which plan to launch in April, will serve as the basis for futures and options contracts that will trade on the Chicago Mercantile Exchange.Read the whole thing here (online subscription required).The contracts will allow investors to go long or short on a specific housing market -- that is, bet on it rising or falling in value.

Dubbed the S&P/Case-Shiller Metro Area Home Price Indices, the 10 cities comprise Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco and Washington, D.C.

The "Shiller" in the "S&P/Case-Shiller" is Robert Shiller of Yale, who is one of the biggest names in academic finance. Outside the academic world, he's known for his book "Irrational Exuberance", which called the bursting of the stock market bubble in the late 90's. In recent years he's been working on housing indexes. It's good to see his work finally coming to fruition.

According to the WSJ, the indexes will be used as the basis for contingent claims (i.e. options and futures) that will trade on the Chicago Mercantile. Given the size of the housing market and the multiple ways it affects different economic players, I predict that there'll be a huge market for these contracts.

Easy Money, and Sex With Porn Stars

Before you ask what he was thinking when he answered a casting call for porn stars, let the man explain himself. Then those without sin may cast the first jokes.Click here for the whole thing“The way it was described sounded good to me: making movies with Playboy Bunnies,” said the 45-year-old Revere bachelor with chisled cheekbones and a head of dark hair even the young Al Pacino might covet. Telling his tale in a Herald exclusive, he insisted on being identified only as “Joe.”

Lured like a moth to the blue flame of the X-rated film industry, Joe was burned for $16,000 by scam artists who placed a classified ad in the Boston Phoenix under “!Diamond Productions.”

There are so many directions I could go with this, I'm not quite sure where to start. Other than to wonder if he knows this guy, I'll leave it to my commenters to chip in.

Thursday, March 23, 2006

Why Is CEO Pay So High?

HT: Monty's Bluff

Update: I'm actually not in the "CEOs make too damn much money" camp - the cartoon was something I found amusing, rather than a reflection of my views. Equity Private has taken the time to put together an excellent set of arguments that CEOs aren't overpaid at all (with lots of nice graphs). EP summarizes the arguments here:

...So let's review. Longer term, riskier and more contingent compensation. Lower salaries as a portion of total compensation. Substantially increased legal risk, both civil and criminal. Short-term focus on returns by the short-term focused markets. Add to this a private equity sector that, in terms of total investments in 2005, could buy up nearly 10% of the Dow Jones Industrials, and it becomes clear that the market (in this case composed mostly of institution money) is increasingly counting on private equity as the more efficient deployment of capital over the highly regulated public markets. Keep it up, America. Right or wrong, we private equity folks love the massive flood of senior management talent currently being driven our way out of public companies.Well done. Read the whole thing here.

Moebius Stripper Sets The Student Straight

In this piece, titled Your stupid misconceptions addressed she writes:

I’d have nothing worth blogging if it weren’t for the fact that one of my former students recently took me to task in the comments section on my most recent post!She then proceeds to thoroughly fisk the student's comments. If you're an academic, read it - it's a classic - I've heard most of this student's complaints before (we all have), and thought of responding in Moebius' fashion. Luckily, I haven't, since I'm not tenured. But, as Chris Rock would have said, "I can understand it".Just kidding! Reader Carolyn wasn’t one of my students; rather, she’s a genetically engineered composite of every student that every academic blogger has ever complained about. O Lord, thank you for this bounty.

Wednesday, March 22, 2006

Cramer vs. A Coin Flip

Jim Cramer has quite a following, but it looks like his stock picking ability is no threat to the theory of Efficient Markets. Mark Mahorney of Bloggin Wall Street has put together an analysis of Cramer's picks over the last three months, and it's not too flattering to Cramer. He writes:

TheStreet.com has put up a screener tool to screen against Cramer'’s Mad Money stock picks. There'’s a rolling 3-month database containing all of his calls… Surprisingly, if you give the screener no specific criteria you can get a list back of all 1885 calls in a table that will dump right into a spreadsheet perfectly…There are 1077 buy calls and 477 sell calls for a total of 1554 buy or sell calls… The 1077 buy calls are up an average of 2.88%… The 477 sell calls are up an average of 3.52%! They'’re not only down, but they'’re up by more than the buy calls. Averaging the 1077 gains of 2.88% with 477 losses of 3.52% we get a whopping total gain of 0.5%

So, Cramer's sell recommendations have actually gone up by more than his buy ones - not exactly a stellar record. Plus, he can be kind of irritating. My take is that you're better off watching the show strictly for entertainment value and just putting your money in a couple of low-cost index funds.

Note: If you're new to Financial Rounds , welcome. I hope you look around a bit -- if you want to find out more about the blog, check out the Frequently Asked Questions (FAQ) page. And if your want to subscribe to our RSS feed, there are links on the sidebar.

Under The Counter

It's all about the people, Stupid. Who's getting paid, laid, hired and fired on The Street.All in all, it's a pretty good read, particularly if you're trying to get a feel for the personalities, lifestyle, and mindset of the dwellers on The Street.

When Is An Efficient Frontier Not An Efficient Frontier?

What's wrong with this quote made by Ranji Nagaswami of Alliance Bernstein?

What's wrong with this quote made by Ranji Nagaswami of Alliance Bernstein?The whole job here is to identify a group of asset classes that have as low correlations as you can possibly get, so that when something is not working, something else always is. By pulling together these negatively correlating assets you actually improve the risk-return tradeoffs. You can get above the so-called efficient frontier. The efficient frontier itself gets most people pretty close to a good solution, but we think being a little bit more thoughtful by style, geography, and capitalization can get you above the efficient frontier. That'’s our goal, right?As Robin Williams said in Dead Poet's Society, "BZZZZ! Wrong. You're an Amoeba. Thanks for Playing".

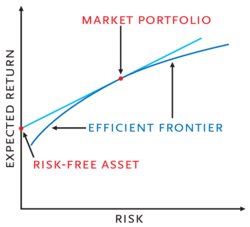

If you mapped out all possible combinations of assets and picked the ones that give you the lowest possible risk (i.e. standard deviation in returns) for a given return (or alternately, the highest return for a given level of risk), you'd have the efficient frontier. The picture above from Wikipedia illustrates what such graph would look like.

The curved line (labeled "Efficient Frontier") is actually the set of minimum variance combinations if if you didn't have a risk free asset as one of your investment choices. By definition, these are the BEST risk-return combinations available among all risky assets.

In addition, if you had a risk-free asset available as one of your investment choices, you could create an even better combination of assets than the "no risk-free asset" efficient frontier. By combining the risk-free asset with the right combination of risky assets (the "market portfolio), you can create a better combination of assets from a risk-return perspective. This is demonstrated by the blue line residing above the curved one. By convention, this straight line is typically referred to as the "Capital Market Line". In effect, it's the "Efficient Frontier" with a risk-free asset as one of the investment choices.

So the bottom line is that, by definition, you can't get above the efficient frontier. If "you can get above the so-called efficient frontier", it isn't the efficient frontier.

Or, as Inigo Montoya would have said, "You keep using that word. I do not think it means what you think it does".

HT: ETF Investor

Yak Shaving Razor #45 (from The Evangelical Outpos)t:

Recipe site Allrecipes lets you search their extensive recipe database based on ingredients you’d like to use. Not only that, but you can also specify ingredients you don’t want, and you can limit your search to the type of food you’re looking for. (HT: LifeHacker)For the archives of the Yak Shaving Razor series, click here.

Monday, March 20, 2006

Catch Phrases And Eating Soup With A Knife

I'm a big fan of using "catch phrases" in my classes (a catch phrase is an easily remembered phrase that illustrates a recurring theme). For example, the first day of class, I teach them that the value of anything is based on "The Amount, Timing, and Risk Of Its Cash Flows." I repeat this so often, whenever I ask them what's the value of anything based on, they should automatically answer "The Amount, Timing, and Risk Of Its Cash Flows." Later on, when we cover present value, I amend this to "The Value Of Anything is The Present Value Of Its Cash Flows". This gets repeated so often, it ends up in the very front of their memories.

Today, I learned a new catch phrase to inflict on my students. It came from a Wall Street Journal article on a book titled "Learning to Eat Soup with a Knife". The title came from a famous line of T.E. Lawrence, also known as Lawrence of Arabia: "To make war upon rebellion is messy and slow, like eating soup with a knife."

Here's how I'll use it: Some of the techniques I try to teach students take a bit of effort to become comfortable with. As one example, consider a financial calculator: it takes a bit of time learning how to use the cash flow register to solve for the present value of an irregular stream of cash flows. However, there are some problems for which using the cash flow register allows the student to obtain a solution in about a third of the time it would take using any other solution method. Unfortunately, since it's not immediately easy, some students persist in solving a problem using any method other than the cash flow register.

I try to explaining how their way of solving the problem is less elegant and a lot more time consuming than using the cash flow register. Now, before I do that, I'll reinforce it by saying that their approach is "like trying to eat soup with a knife -- messy and slow". After hearing that repeatedly, with a bit of luck it'll sink in.

The phrase works in a lot of situations, so it'll probably become a mainstay in my classes.

New Additions To The Blogroll

The Happy Capitalist is "an over-forty financial advisor" living in Northern California. He's got a good mix of business and finance commentary and personal observations (and some good cartoons).If you have any other recommendations for blogs to add, please let me know (and why).

Ask Uncle Bill has a fair amount of personal finance advice, but also makes comments about finance issues of the day.

Kirby on Finance is primarily a personal finance site. It updates about twice weekly, and is pretty well written, covering wide variety of issues.

I've saved the best for last. Going Private is a newer blog run by an unknown private equity (i.e. buyout and venture capital) professional named Equity Private. EP has a great mix of posts - sometimes it's solid commentary on financial issues related to private equity, and sometimes it's a recounting of the almost "soap opera-esque" lives of the people involved. I only wish there were more frequent updates, but I can understand it - EP has pretty high opportunity costs.

This Week's Carnival Of The Capitalists

In The Art of the Handshake, Steve Mertz talks about the importance of a "good" handshake.That's it for this week. Check around to see what else is there, since there's always an amazing selection of things at the COTC.

Random Thoughts discusses Getting a "Stop Doing" list. The best line? "Saying NO is never easy but has to be done."

Dan Melson at SearchLight Crusade talks about Debt Consolidation Refinance - Pros and Cons. As always, Dan has an extremely informative post, with things you can actually use.

Perry at Eidelblog asks a very good question: If your compensation isn't enough, why do you work there? If a person had a better option, they would take it.

The Net Worth Blog points out that “past performance is not an indicator of future performance" in Beware Historical P/E.

VoluntaryXchange breaks down zero-coupon bonds (and their tax implications) in The Phantom Tax and IRS Pinheads. Don't hold back - tell us what you really think, Dave.

This Week's Carnival of Personal Finance

Searchlight Crusade highlights a recent article showng that loan brokers give better deals than banks (at least where sub-prime borrowers are concerned).As usual, check out the other submissions. My situation, needs and tastes are different from yours, and you might find some of the others interesting, too.

Dave at Pacesetter Mortgage describes how lenders sell the informatiion that you've applied for a loan.

Career Intensity runs through how to ask for a raise (and just as important, how not to).

A Geek's World gives some good reasons why you should be paying bills online.

Thursday, March 16, 2006

Calculating and Understanding Real Interest Rates

For a good explanation of the topic (and an example of how to calculate real rates), read the following piece put together by Mike Moffatt at About Economics titled Calculating and Understanding Real Interest Rates.

Convincing the Other Team's Player That He Has an Online Girlfriend? Priceless!

On March 4, University of California Berkeley (Cal) played a basketball game against the University of Southern California (USC). With Cal in contention for the PAC-10 title and the NCAA tournament at stake, the game was a must-win.Click here for the whole thing.Enter "Victoria."

Victoria was a hoax UCLA co-ed, created by Cal's Rally Committee. For the previous week, "she" had been chatting with Gabe Pruitt, USC's starting guard, over AOL Instant Messenger. It got serious. Pruitt and several of his teammates made plans to go to Westwood after the game so that they could party with Victoria and her friends.

On Saturday, at the game, when Pruitt was introduced in the starting lineup, the chants began: "Victoria, Victoria." One of the fans held up a sign with her phone number.

The look on Pruitt's face when he turned to the bench after the first Victoria chant was priceless. The expression was unlike anything ever seen in collegiate or pro sports. Never did a chant by the opposing crowd have such an impact on a visiting player

It's not too surprising both that they tried it and that it was successful. After all, getting the opponent's goat is a long standing tradition for the fans of the home team (it's part of the "home team" advantage). And we're talking about a 20 year old guy here, and an athlete at that. So, there's probably a mismatch between testosterone and that little voice in the back of the head that says "Now wait a minute, Jack. This could be a hoax -- what do I really know about this person?".

Still, it is pretty funny. Someone should make a MasterCard commercial out of it.

HT: Newmark's Door.

Wednesday, March 15, 2006

Believe it or not, some people like meetings

Believe it or not, some people like meetings

Tuesday, March 14, 2006

Frequent Testing Leads To Better Learning

...students understood and retained information more readily when subjected to frequent tests and quizzes while studying than students who simply read material over and over again.In my introductory finance course, I give four tests (each covering about 3 chapters) AND a comprehensive final, 4-5 quizzes, and assign 5 problem sets. Now, when the students complain, I'll point them towards this piece."Our study indicates that testing can be used as a powerful means for improving learning, not just assessing it," said Prof Henry Roediger of the university's psychology department.

The results are published in the current issue of Psychological Science. According to Prof Roediger, students who relied on repeated study alone frequently developed a false sense of confidence about their mastery of the materials even while their grasp of important detail was sliding away. By comparison, students who were either tested repeatedly or tested themselves while revising scored dramatically higher marks.

HT: Joanne Jacobs

New Evidence On Racial Test Score Gaps

Levitt and Fryer find that little differences in test scores between black and white children in the fall of their kindergarten years (blacks score less than 1/10 of 1 standard deviation below whites on math scores at kindergarten age and actually are slightly above whites in reading scores). However, with each year of schooling, black children fall further behind.

It's an interesting piece, and I predict it'll get cited in the popular press often in the next few months. If you want the paper (in PDF format) click here.

This Week's Carnival Of The Capitalists

Searchlight Crusade breaks down tax-free exchanges of real estate in The Basics of 1031 Exchanges.That's it for now. Don't forget to look around - there's always lots of good things at a Carnival, and you might enjoy some of the things I skipped over.

Ripples: post-corporate adventures discusses Tripadvisor.com in Good friends do not let friends stay in rat-bag hotels (love the title of the post)

interim thoughts has some interesting commentary on Corporate Social Responsibility.

The Coyote Within has some good career-related advice in Where Do I Go From Here?. Asking some of these questions 15 years ago eventually led me to my current career.

Econbrowser considers The latest employment figures: implications for policy. He has some great discussion of tax policy, the possibility of interest rate increases, and other issues.

Everybody seems to have jumped on the "boards should only have independent members" bandwagon. As usual, ProfessorBainbridge.com has a somewhat different take in A Justification for Insider Board Representation.

Monday, March 13, 2006

More Free Stuff (from One Money Dummy Getting Smarter)

Parent-Onomics: The Economics of Dealing With Your Kids

It's go-home time at my daughter's preschool. I see a parent struggling to get snow pants on his toddler in an 80-degree room. I think: "Where's the incentive compatibility in that?" I do it the easy way: I scoop up my daughter in my right arm and her winter clothes in my left and out the door we go. Whereupon, in the 30-degree cold, she dons her winter duds at a speed rivaled only by local firefighters answering a call.Read the whole thing here.Before you accuse me of being a cold-hearted economist, consider: his daughter was crying, mine was not; he was exasperated and grumpy, I was not. So who's on higher indifference curves?

...

I think economic principles have a lot to offer parents. Parents hold considerable sway over their kids. Maybe not as much as they like, but nonetheless: what parents do affects their child's incentives. And the main take-home message of economics is that incentives matter.

Bryan Caplan notes that most of Cox's anecdotes are geared towards young children. He gives an application to teenagers here.

The Unknown Wife and I often find ourselves in these situations. Whenever we want our kids to do something that they don't wnat to (like clean their rooms, or put the dishes away), she tries to convince the kids that our way is wisest and micro-manages (I do this sometimes too). Unfortunately, this makes getting the task done OUR responsibility, and we bear all the costs. So, there's no incentive compatibility there.

In our better moments, we use what an economist would call "noisy ex-post settling up". Here's how it works. Let's assume that we tell our kids to pick up their rooms. Here's the way it plays out:

- Child #1: I don't want to.

- Child #2: works for about 2 minutes and then plays his game boy.

- Us: "Well, that's your choice." Then we leave the room and neither mention it again nor do anything else at that time.

Just before we go, we say "Oh, I forgot -- we're not going."

The kids will go ballistic, and ask why. We reply, "When we asked you to pick up your rooms, it was your choice, and you chose not to. Now, whether or not we go for ice cream is OUR choice. And we choose to not go."

This allows us to pick the time and place of the consequence, so that it really smarts. Setting a consequence on the spot means we might not hit the kid's hot button. Doing it after the fact makes it much more likely that we'll get them where it counts.

Before, I used the term "noisy ex-post settling up"". Here's the explanation for the term in non-technical language: "Noisy" means there is some randomness to when and where we give the actual consequence; "ex-post" means "after the fact", and "settling-up" is pretty much self-explanatory.

This is also very similar to the way the real world hands out consequences. If you screw up, you don't know when or where you'll pay for your choices.

It may seem Maciavellian, but it works amazingly well. We can't claim authorship of this approach - we got it from the books written by John Rosemond, who is probably the best child-rearing maven around (and funny, too).

Any thoughts?

This Week's Carnival of Personal Finance

A Financial Revolution asks the question How Many Stocks Are Needed To Reduce Risk? The answer is, not that many.That's it for now. Look around a bit after you've read these. After all, as I say every week: my tastes, needs, and background are different from yours. So, the things that don't do it for me might be just what you want or need. That's what's great about Carnivals - there's always lots to choose from.

Tired But Happy has a horror story titled Rollover IRAs: Not as easy as you think. Since I'll be changing jobs soon, this hit home. Yeeesh!

The parents in Life In a Shoe have some interesting ideas on getting the proper financial attitudes into their kids in Kids For Hire.

When a married couple applies for a loan, do lenders use the credit score of spouse (and if so, which one) or both? Searchlight Crusade breaks it down in Joint Loans.

Dave at Pacesetter Mortgage is continuing his series on how best to finance your home improvement in The #1 Way to Finance a Home Improvement.

Nickel at Five Cent Nickel begins his summary of/commentary on a recent Reader's Digest article on new scams in Ten New Money Scams - Part 1.

Sunday, March 12, 2006

Six Signs It's a Scam (via the Motley Fool)

My guess is that regular readers of blogs on average a bit more sophisticated and well informed than the general public, so they're probably also less likely to fall for scams. However, anything worth saying is worth repeating (repeatedly), so here's another "don't get fooled by scams" post. The Motley Fool has a list of six indicators that you might be looking at a scam:

- The promise of low risk and high gains.

- Warnings that if you don't act now it'll be too late.

- Predictions of the future

- Failing the "background check".

- No prospectus or financial statements

- A hot "inside tip"

These six indicators aren't exhaustive, but they are a good start. IMO, the first two cover the vast majority of scams. Two good rules are that if something looks too good to be true, it probably is, and that anything you can't take the time to analyze is best left alone.

Friday, March 10, 2006

How Not To Keep Your Job (Unless You're Tenured)

While his students were watching a movie on three screens, Suffolk University professor Luis Garciahe was busily watching porn on his laptop. Unfortunately for him, he didn't realize that he was also projecting it onto the big screen. But luckily for him (if not for his students) he's tenured, so he'll probably keep his job.

Of course, he was "just doing research for a later class module." Yep.

Supposedly, the class continued for 30 minutes after the incident, and none of the students mentioned it to Garcia. So, he remained blissfully unaware of what he'd done until one of the students reported it to the administration. I know that part couldn't have happened at my school, because I doubt my students could gone that long in class before asking "Will this be on the exam?"

Bugs Bunny has some thoughts on the matter, here, and Mike Munger has some further observations here, along with a link to a funny-but-not-work-safe video clip that I wish I'd thought about linking to.

How To Be An Expert

How do people become experts?

If you asked the guy on the street how the "best of the best" got that way (whether it's math, playing guitar, or whatever), they'd say that these people were born with a gift of some sort. Kathy Sierra at Creating Passionate Users disagrees, and she's written the best piece on this topic I've read all year:

The only thing standing between you-as-amateur and you-as-expert is dedication. All that talk about prodigies? We could all be prodigies (or nearly so) if we just put in the time and focused. At least that's what the brain guys are saying. Best of all--it's almost never too late.She also highlights some research by Florida State University psychology professor Dr. K. Anders Ericsson, who's made a research career out of studying prodigies, geniuses (of which I'm neither) and top performers:

In the book The New Brain (it was on my coffee table) Richard Restak quotes Ericsson as concluding:

Read the whole thing here."For the superior performer the goal isn't just repeating the same thing again and again but achieving higher levels of control over every aspect of their performance. That's why they don't find practice boring. Each practice session they are working on doing something better than they did the last time."

So it's not just how long they practice, it's how they practice. Basically, it comes down to something like this:

Most of us want to practice the things we're already good at, and avoid the things we suck at. We stay average or intermediate amateurs forever.

Reading Between the Lines

While you may not be able to read her mind, you do need to read in between the lines. Here is a brief guide to what people say and what it is they really mean:“I don’t kiss up to anybody.” -- Translation: I’m a tactless jerk.

“It’s not you, it’s me.” -- Translation: Let’s not kid ourselves, you’re definitely the reason we’re breaking up.

“We need to talk about our relationship.” (Spoken by a woman) -- Translation: We need to talk about what you’re doing wrong.“Fine, let’s talk.” (Coming from a man) -- Translation: Please, please, let’s get this over with before the football game comes on.

Read the whole thing here.

Thursday, March 09, 2006

Piled Higher and Deeper

Be warned if you're a graduate student (or even junior faculty)-- there are several years of strips, so it could be a real time waster. On occasion, it nails the doctoral student experience.

Wednesday, March 08, 2006

The Devil's Dictionary For Stock Markets

Now I find out that John Dorfman is working on one for the stock market. Here's a sample:

Pro forma earnings: A company's self-serving earnings statement in which unfavorable things are disregarded on the grounds that they don't really matter.Read the whole thing here.

HT: The Big Picture

Tuesday, March 07, 2006

Updates From The Job Hunt

I flew in the night before. Unfortunately, this means that things started with a delay, since my destination airport was snowed in. There was an hour delay getting into the air, the plane had to circle the airport thrice before landing, and we ended up waiting on the runway for another 30 minutes after landing before taxiing to the terminal. But, we finally got in, and I went to dinner (around 7:30 or so) with a couple of the faculty from the school.

The next day, the interview started with breakfast at 7:30, followed by two separate 45 minute interviews with faculty, followed by a ninety-minute presentation of my current research, followed by lunch, followed another four 45-minute meetings with various other faculty (one of which was the Dean), followed by dinner with another faculty member, followed by a plane ride home.

Final tally - four meals with faculty, six 45-minute meetings with different faculty, a ninety minute research presentation and two plane rides - all within a little more than 27 hours. And then, collapse into bed exhausted for about 12 hours.

My impression was that it went well. It's very different (and oh, so much easier) interviewing for a job when you already have one. I was as relaxed as I've ever been on campus visit (and this is the 8th time I've had one of these over the years, so I've got some reference points).

I knew quite a bit about the faculty beforehand due to some personal connections, so I was very well prepared. The presentation went as well as any I've ever given (interestingly enough, a lot of that was thanks to tips on presenting I'd picked up around the blogosphere). I knew that there would be some accounting faculty in the audience, so I chose a topic that fit into the seams between finance and accounting, and I ended up with a lot of audience participation and some pretty good comments. I was a bit concerned before the presentation since there are a few "problem children" on the finance faculty, but they didn't bother to attend. From what the others had told me about these two, absence definitely makes the heart grow fonder, so even that worked out.

Everything I heard during the day convinced me that the position would be a great fit for me. And as we concluded our meeting, the Dean said, "UP, I'm very optimistic about your chances. And that's a very good sign, since I'm the one who makes the final decision".

Now, we wait to hear from them (the hardest part). I've been told by a friend on the faculty that an offer (if I get one) could be forthcoming as soon as next week. If it works out, I'll wait until my travel authorization for a conference next month is approved and then tell my current chair so (s)he can plan for next semester.

We have a joint accounting/finance department, and we lost two accounting faculty last year (we haven't filled their positions yet). In addition, one of our other accounting faculty just announced she's leaving in the fall.

So, when I tell our department chair, it's entirely possible his/her head may just explode on the spot.

Time for another nap, and then some grading.

UPDATE 1 (Saturday): I just heard from my friend on Unknown U's faculty, and he said that he has gotten uniformly positive feedback from everyone he's talked with - particularly regarding my presentation.

UPDATE 2 (Monday): According to my mole on the inside at Unknown U, my offer is currently winding it's way through the black hole of affirmative action. I should get a verbal offer in the next couple of days. I know that verbal offers aren't worth the paper they're written on (and I'll wait for the written one before I start mentally packing), but I still have to say,

Woo Hoo!

Monday, March 06, 2006

This Week's Carnival Of The Capitalists

Searchlight Crusade discusses what to do if you think you've been sold a bad mortgage.As always, look around. There's always lots of good stuff at the COTC, and my picks might not be what trip your trigger.

This one made me do a triple (not double) take. Roth & Company start out with : "Two women are donating kidneys to each other's husbands. ... they may have taxable income from the swap"

Going Private discusses why merger arbitrageurs haven't made a great returns recently. The main reason? The market for "corporate control" has become more efficient.

Photon Courier discusses some recent academic research that shows that investors switch in and out of mutual funds at the worst times.

James Hamilton at Econbrowser examines near term oil supplies.

Big Picture, Small Office recounts a few lessons he learned from watching a master negotiator.

Sunday, March 05, 2006

Maximizers and Satisficers

A recent study by Barry Schwartz examined the outcomes (salaries and job satisfaction) of job choices made by "maximisers" and "satisficers". In case you're unfamiliar with the terms, the two types are simply those who shoot for the best possible outcome and those who are happy if they hit a certain target (i.e if they get a certain income, that's good enough and they're happy). Here's an excerpt:

Five hundred and forty-eight graduating students from 11 universities were categorized as maximisers or satisficers based on their answers to questions like "“When I am in the car listening to the radio, I often check other stations to see if something better is playing, even if I am relatively satisfied with what I'’m listening to"”.I was a maximizer when younger, but I've become increasingly more of a satisficer over time. I wouldn't be surprised if that's the natural progression. As I've gotten older, I've come to the realization that only a very, very few things matter (I'll let you figure out what they are). So, I try to be more of a mazimizer for them. In order to do that, I settle for "good enough" in everything else.

When questioned again the following summer, the maximisers had found jobs that paid 20 per cent more on average than the satisficers'’ jobs, but they were less satisfied with the outcome of their job search, and were more pessimistic, stressed, tired, anxious, worried, overwhelmed and depressed.

How about you?

HT: Marginal Revolution

Saturday, March 04, 2006

Surviving Faculty Meetings

I used to be a Talker when I started out, but I realized that no one cared what I said, and making the meeting drag on ticked people off. So now, I just sit in the back, keep quiet and read a journal article or two.

For new faculty, here are some simple rules for surviving faculty meetings without damaging yourself:

Rule #1:Thou shalt keep thy mouth shut until tenured.HT: Steve Bainbridge.

Rule #2: If you have great comment to make, refer to rule #1.

Rule #3: Always bring something to work on unobtrusively in the back. Use the time to catch up on your journal reading. This will help you to follow rule #1.

Rule #4: Come early enough so that you can sit in the back (see Rule #3).

Rule#5: Do not take sides in contentious disputes. Just. Don't. If you take someone's side they won't remember it ten minutes later, and those on the other side may hold it against you.

Rule #6: If you want to be seen as a contributor and just can't live with yourself without speaking up, limit yourself to ONE comment per meeting, of no more than 15 seconds' length. So, choose carefully. Better yet, refer to rule #1.

Wednesday, March 01, 2006

Academic AWOL

Of course, the later you get, the less you want to see the other person, and the higher the standard you hold yourself to (the "If I'm going to turn it in late, I'd better make it REALLY good" syndrome). Of course, this makes it more likely that you'll procrastinate. After a while, it spirals out of control, and you avoid the other person at all costs, sometimes to comical extremes.

Mary McKinney at Academic Coach has a great piece on this problem over at Inside Higher Education. It's titled Academic AWOL, and it should be required reading for doctoral students and junior faculty everywhere.