Today was a good day to be teaching investments. My student managed investment fund class was a bit shell shocked at losing 3 1/2 % of the fund's value in one day (we meet on a MWF schedule, so there wasn't class on Tuesday). .And 100% of our 20+ positions in the fund ended in the red for the day (hence the title of this post). So, there was a lot of discussion about the various stories explaining the drop (Shanghai, bad economic news, and the ever-popular "Greenspan said we're due for a recession").

The biggest positive of this experience is that it has sharpened their focus on the "downside" of being in the market. If you're going to be in the market, you have to see a major correction at some point, and it's better to see it earlier than later (and it's even better if you can experience it with some else's money). We spent a lot of time discussing some positions we plan on exiting and whether or not to sell now, wait and see, or put in stop losses. Of course, I won't tell you what they decided.

But on the good side, the fund has clawed back almost 8/10 of a percent today. It's still not great, but it is an improvement over yesterday's results.

update: It was interesting teaching CFA last night - I got to talk with a couple of equity traders. One had been at it for about 7 years, and had a lot of relatively young guys in her group (almost all had started post 9-11). She enjoyed the panic they expressed since they'd never experience a correction like this. So it's not just my students.

The finance classroom meets the outside world (and vice-versa). Back away slowly from the computer with your hands up and your mind open, and with luck nobody gets hurt.

Wednesday, February 28, 2007

Tuesday, February 27, 2007

The Private Equity and Academic Research Link Dump

It's been a while since I did a proper link dump, so it's time to clean out the buffer. I teach CFA again tonight, so I have to leave shortly and prepare. But in the meanwhile, here are some links for your reading pleasure. As usual, they're heavy on Private Equity and Academic research:

That should keep ya busy. Time to catch my train.

Hedge Fund and Private Equity

Mark Hulbert discusses the effectiveness of hedge fund activism in the New York Times (online subscription required).

In a related piece, Equity Private at Going Private is blogging on the relations between Private Equity and Shareholder Activists. The Cliff Notes version (but definitely read the whole thing) is that the two groups have a lot of overlap, but also provide different mechanisms for resolving agency problems.

Texas Pacific Group's founding partner David Bonderman made some opening comments at today’s Super Return 2007 private equity conference in Frankfurt

Academic Research

Green, Jegadeesh, and Tang (three finance profs at Emory University) examine the performance of men vs. women analysts in Gender and Job Performance: Evidence from Wall Street. Dang - another piece I wish I'd written.

Fama and French have just written another interesting piece on the size and market-to-book effects titled "Migration. They study ..."how migration of firms across size and value portfolios contributes to the size and value premiums in average stock returns. The size premium is almost entirely due to the small stocks that earn extreme positive returns and as a result become big stocks. The value premium has three sources: (i) value stocks that improve in type either because they are acquired by other firms or because they earn high returns and so migrate to a neutral or growth portfolio; (ii) growth stocks that earn low returns and as a result move to a neutral or value portfolio; and (iii) slightly higher returns on value stocks that remain in the same portfolio compared to growth stocks that do not migrate." HT: Jim Mahar at Financeprofessor.com

Finally, Boudoukh, Michaely, Richardson, and Roberts have a forthcoming Journal of Finance piece titled "On the Importance of Payout Yield". They find that "...the widely documented decline in the predictive power of dividends for excess stock returns is due largely to the omission of alternative channels by which firms distribute and receive cash from shareholders. Statistically and economically significant predictability is found in the time series when payout (dividends plus repurchases) and net payout (dividends plus repurchases minus equity issuances) yields are used instead of dividend yield."

That should keep ya busy. Time to catch my train.

Sunday, February 25, 2007

Advice to New Faculty

Greg Mankiw's Blog is a must read for aspiring economists. He just posted some spot-on "Advice for Junior Faculty" the best pieces IMO are:

- Focus on getting papers published - everything else is secondary. And don't be a perfectionist. Get the thing out the door and onto a referee's desk.

- It pays to be a good teacher and a good citizen in your department, but it won't get you tenure

- Attend conferences and give seminars at schools to publicize your work and yourself.

- Give each of your papers a shot or two at the top journals, such as the AER, JPE, or QJE.

- Do not get discouraged by rejection.

- Schedule time for writing every day (preferably first thing). It doesn't have to be a lot - just commit to 30 minutes every day. Other things will creep in and steal your time So do it first.

- Read Boice's Advice For New Faculty Members. It's short, cheap, and well worth the read. And it'll get you started on your careers with good habits.

Friday, February 23, 2007

Hopefully The Last In a Series

I hope this doesn't jinx things, but the latest round of Zithromax seems to have had a good effect on the pneumonia. Good thing, 'cuz I have multiple coauthors clamoring for attention. So with luck, I can get back to being somewhat productive.

Today's an exam day, so it's an easy one for me. Unfortunately, the grading comes later, which is my least favorite part of the job (that, and committee meetings). But the rest of the day is carved out for working on a rewrite of a 45 page paper. Woo hoo!

Hopefully, this will be the last of the "I'm still sick" posts for a while.

Today's an exam day, so it's an easy one for me. Unfortunately, the grading comes later, which is my least favorite part of the job (that, and committee meetings). But the rest of the day is carved out for working on a rewrite of a 45 page paper. Woo hoo!

Hopefully, this will be the last of the "I'm still sick" posts for a while.

You can pick your frends, you can pick your nose, and you can PIK your bonds

Wednesday's WSJ had a very interesting piece on "PIK " or "Payment In Kind" bonds, titled "What's Aiding Buyout Boom: Toggle Notes." It's perfect to bring into the classroom if you're teaching about capital structure, M&A, financial engineering, or derivatives.

For the unitiated, a payment in kind toggle (I'll just call them PIK bonds from here on out) bond gives the issuer the option of not paying coupon payments. If they exercise the option (i.e. "flip the toggle"), the liability for the missed payments payments accrues (at an interest rate higher than the coupon rate) and is repaid at maturity. The article notes the recent PIK bond issued in the takeover of Neiman-Marcus - it has a 9% coupon, and a 75 basis point higher (i.e. 9.75%) rate on "toggled" payments.

In a Miller and Modigliani 1958 world, there aren't any costs to financial distress. In the real world, there are serious consequences to missing a coupon payment. Even more, actions taken to avoid this eventuality can cause distortions in firms investment and disclosure activities. So PIK bonds are a creative financial engineering solution to the problem.

It's not surprising that PIK toggle bonds have been seen mostly in the PE world. These deals end up highly leveraged. So, there's a significant risk that a target firm could get driven under by an external shock completely out of their control (the article uses 9-11 as an example). And the "insurance" seems pretty cheap at 75 basis points.

It's also interesting in terms of how you'd price the option. Since the option would be exercised if the firm was underwater on its debt payments, it's actually an option on the cash flows of the firm rather than on a traded security. Since the issuing firm has a much better feel for those numbers than the credit markets do, there should be a significant adverse selection problem with these securities. My guess is that the insurance (the 75 b.p. spread on the toggled payments) will turn out to be way too low.

There's some good commentary on the topic from the usual suspects: Abnormal Returns has a nice roundup of PE/credit related posts, and Going Private analyzes the effects of PIK financing on the PE firms equity returns.

And if you have no clue about what a PE firm is and does, here's a pretty good video primer on Private Equity from CNNMoney.com

For the unitiated, a payment in kind toggle (I'll just call them PIK bonds from here on out) bond gives the issuer the option of not paying coupon payments. If they exercise the option (i.e. "flip the toggle"), the liability for the missed payments payments accrues (at an interest rate higher than the coupon rate) and is repaid at maturity. The article notes the recent PIK bond issued in the takeover of Neiman-Marcus - it has a 9% coupon, and a 75 basis point higher (i.e. 9.75%) rate on "toggled" payments.

In a Miller and Modigliani 1958 world, there aren't any costs to financial distress. In the real world, there are serious consequences to missing a coupon payment. Even more, actions taken to avoid this eventuality can cause distortions in firms investment and disclosure activities. So PIK bonds are a creative financial engineering solution to the problem.

It's not surprising that PIK toggle bonds have been seen mostly in the PE world. These deals end up highly leveraged. So, there's a significant risk that a target firm could get driven under by an external shock completely out of their control (the article uses 9-11 as an example). And the "insurance" seems pretty cheap at 75 basis points.

It's also interesting in terms of how you'd price the option. Since the option would be exercised if the firm was underwater on its debt payments, it's actually an option on the cash flows of the firm rather than on a traded security. Since the issuing firm has a much better feel for those numbers than the credit markets do, there should be a significant adverse selection problem with these securities. My guess is that the insurance (the 75 b.p. spread on the toggled payments) will turn out to be way too low.

There's some good commentary on the topic from the usual suspects: Abnormal Returns has a nice roundup of PE/credit related posts, and Going Private analyzes the effects of PIK financing on the PE firms equity returns.

And if you have no clue about what a PE firm is and does, here's a pretty good video primer on Private Equity from CNNMoney.com

Thursday, February 22, 2007

Still On The Mend

Just Damn.

At the beginning of the week, I still had mild fevers (about 101.5-102), coughing fits, and lots of wonderful stuff coming up from my lungs. So, I went back to the Doc. I told her that I'm really not stalking her (hey - she's young and cute, so at least there's some payoff to these visits), but that I was hoping that it's like a coffee shop where every tenth visit is free.

I finally had an X-Ray done, and there's a significant amount of goop (at least, I think that's the technical term for it) in my lower lungs. The actual diagnosis? It's either viral pneumonia that hasn't resolved yet or bacterial pneumonia that the first does of antibiotics (Levaquin) didn't quite knock out. So, it's on to a second round of antibiotics (Zithromax this time). If it's the first case, the antibiotics will keep anything else from growing there, and if it's the second, this additional dose should do the trick.

Doc said that Zithromax has the unfortunate downside of causing "some lower GI effects" (i.e. diarrhea). I'm hoping it'll cancel out the constipation caused by the codeine based cough suppressant I'm taking (sorry - that's a clear case of WAY too much information). So with luck, they'll cancel each other out. Yeah, right.

It's been three days since I started the new regimen, and I felt much better this morning. With luck, I'll be back to my old self. I was hoping for better, but I guess I can live with that.

At the beginning of the week, I still had mild fevers (about 101.5-102), coughing fits, and lots of wonderful stuff coming up from my lungs. So, I went back to the Doc. I told her that I'm really not stalking her (hey - she's young and cute, so at least there's some payoff to these visits), but that I was hoping that it's like a coffee shop where every tenth visit is free.

I finally had an X-Ray done, and there's a significant amount of goop (at least, I think that's the technical term for it) in my lower lungs. The actual diagnosis? It's either viral pneumonia that hasn't resolved yet or bacterial pneumonia that the first does of antibiotics (Levaquin) didn't quite knock out. So, it's on to a second round of antibiotics (Zithromax this time). If it's the first case, the antibiotics will keep anything else from growing there, and if it's the second, this additional dose should do the trick.

Doc said that Zithromax has the unfortunate downside of causing "some lower GI effects" (i.e. diarrhea). I'm hoping it'll cancel out the constipation caused by the codeine based cough suppressant I'm taking (sorry - that's a clear case of WAY too much information). So with luck, they'll cancel each other out. Yeah, right.

It's been three days since I started the new regimen, and I felt much better this morning. With luck, I'll be back to my old self. I was hoping for better, but I guess I can live with that.

Saturday, February 17, 2007

Two Nobel Winners For The Price of One

Today's Wall Street Journal has an interview of Nobel Prize Winner Thomas Schelling by his student Michale Spence (another Nobel winner). It's a must read - Schelling and Spence discuss nuclear deterrence and other weighty topics.

Thursday, February 15, 2007

Thursday Link Dump

It's been a good week. I'm slowly getting over the creeping crud in my lungs, my classes are on track, and some exciting things are happening at Unknown University. A number of my undergrads are interested in forming a self-study group in the fall to work towards taking the CFA Level 1 exam in December. The dean has agreed to provide funding for both the required reading AND a set of the self-instructional materials from one of the major vendors --we're in the process of redesigning our finance curriculum to bring it more in line with the CFA program, and this fits perfectly. So, I may end up the unofficial advisor to the newest student organization in the college.

In the meanwhile, here are a few links to keep you busy and off the streets (bedsides -- it's too damn cold up here to go outside):

In the meanwhile, here are a few links to keep you busy and off the streets (bedsides -- it's too damn cold up here to go outside):

Flexo at Consumerism Commentary posted about a guy who's made some money suing telemarketers in small claims court. I love the idea.Given that I finally have some energy, I decided not to waste any more of it today on blogging. So enough blogging - time to do some research.

Dealbook questions whether initial PE buyout bids are being raised or not. And in a related piece, BusinessWeek.com notes that competing bids seem to be on the rise.

The math department at Polytechnic University has some great advice on how to solve problems. They're right on the money for finance students as well as for math students. (HT: Craig Newmark).

Tuesday, February 13, 2007

Tuesday Link Dump - The Merger and Private Equity Edition

I've been a little lax in blogging lately, but I'm still on the mend from the pneumonia. I'm still not anywhere near back to full capacity (and from what I've heard, I won't be for a while), but at least I'm on the mend. I now only have coughing fits mostly in the morning and late evening.

From what I've heard, this thing can take 4-6 weeks to completely beat.

For some reason, the articles that have caught my eye lately have been mostly related to M&A and PE topics. So, I'll just call this the M&A and PE edition of the Link Dump:

From what I've heard, this thing can take 4-6 weeks to completely beat.

For some reason, the articles that have caught my eye lately have been mostly related to M&A and PE topics. So, I'll just call this the M&A and PE edition of the Link Dump:

TheStreet.com has some interesting stock filters. In one, they screen for takeover candidates - firms with high price/cash flow multiples and low debt ratios.Time to get back to work - I've got a lot of catching up to do since I got almost nothing done last week.

A recent WSJ article chronicles how bondholders are bargaining more intensely for a bigger piece of the premiums in PE transactions in Bondholders Fight Back

In another PE-story, CNNMoney.com asks if there's a "private equity backlash".

James Altucher at TheStreet.com has a very nice primer on merger arbitrage (HT: Abnormal Returns)

Finally, the NY Times Online asks the question "Should You Buy When the Smart Money Sells?". The piece discusses the returns investors have historically made from "seasoned" IPOs - IPOs of companies that were taken private and then subsequently taken public a while later.

Friday, February 09, 2007

Made It To The Weekend

Thankfully, it's Friday. I'm feeling much better, and the conference deadline that was supposed to be today has been extended to Monday. So, I might actually be able to do a halfway respectable job on the paper.

I did have one interesting moment today, though. One of my coauthors is a grad student, and I'll be one of the supervisors for her dissertation. She made an error in calculating a measure. In fact, it wasn't a small one - she totally misunderstood the intent of what she was supposed to be trying to accomplish.

As I tried to explain it to her, she kept interrupting and trying to explain what she had done and why. At some point, I simply had to tell her "I really don't care why you did it that way. What you did is wrong, and you need to do it my way." She then wanted me to look at her program to see where she went wrong.

Sorry, that's her problem. It sounds harsh, but it's the best (and maybe the only) way for her to learn. It'll take her far longer to do it than it would take me (by about a factor of 10), but there's a reason why I'm faster - I've done it a lot (and made a lot of mistakes along the way that I've subsequently had to fix).

Sometimes the only way to learn how to do it right is to suck it up and do it, find out where you've erred, and then make corrections.

I did have one interesting moment today, though. One of my coauthors is a grad student, and I'll be one of the supervisors for her dissertation. She made an error in calculating a measure. In fact, it wasn't a small one - she totally misunderstood the intent of what she was supposed to be trying to accomplish.

As I tried to explain it to her, she kept interrupting and trying to explain what she had done and why. At some point, I simply had to tell her "I really don't care why you did it that way. What you did is wrong, and you need to do it my way." She then wanted me to look at her program to see where she went wrong.

Sorry, that's her problem. It sounds harsh, but it's the best (and maybe the only) way for her to learn. It'll take her far longer to do it than it would take me (by about a factor of 10), but there's a reason why I'm faster - I've done it a lot (and made a lot of mistakes along the way that I've subsequently had to fix).

Sometimes the only way to learn how to do it right is to suck it up and do it, find out where you've erred, and then make corrections.

Thursday, February 08, 2007

On The Mend

Ah! I slept in until 10:00 today, and generally poked around the house until 1:00. The added sleep (and the fact that the antibiotics are kicking in) has done a world of good. I'm still hacking and coughing (and will be for a while), but I'm not as bad as before.

Unfortunately, I have to finish a paper for a conference deadline by tomorrow. Since my coauthors "ain't from around here", my job is (as one says) to "Englishize" the paper. I'm really just correcting the more egregious grammar mistakes. But it takes time, and I'm taking longer than usual since I'm not firing on all cylinders.

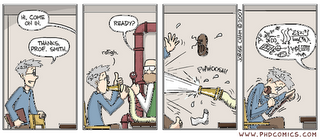

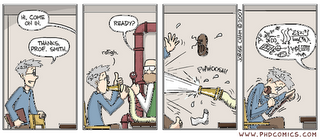

In the meanwhile, here's a cartoon from Phdcomics.com. It pretty much describes my experience in grad school.

Unfortunately, I have to finish a paper for a conference deadline by tomorrow. Since my coauthors "ain't from around here", my job is (as one says) to "Englishize" the paper. I'm really just correcting the more egregious grammar mistakes. But it takes time, and I'm taking longer than usual since I'm not firing on all cylinders.

In the meanwhile, here's a cartoon from Phdcomics.com. It pretty much describes my experience in grad school.

Tuesday, February 06, 2007

Off to Teach

As I just mentioned, I found out yesterday that the cough I've had for the last week is (or has developed into) pneumonia. It still stinks being me, but I got some industrial strength antibiotics yesterday from the doc and some cough suppressant with codeine, which helped with a good (albeit short) night's sleep.

I still have to teach CFA tonight and tomorrow night (and classes tomorrow), but I think I'm on the upswing now. It's probably too soon for the antibiotics to have had any effect, but I feel better already. It's a three hour class -- I'm pretty sure I can last two, but the third might be dicey.

And I'll try not to post this one twice. Hopefully, regularly scheduled blogging will resume shortly.

I still have to teach CFA tonight and tomorrow night (and classes tomorrow), but I think I'm on the upswing now. It's probably too soon for the antibiotics to have had any effect, but I feel better already. It's a three hour class -- I'm pretty sure I can last two, but the third might be dicey.

And I'll try not to post this one twice. Hopefully, regularly scheduled blogging will resume shortly.

Monday, February 05, 2007

Still Under The Weather

No, I haven't died yet. But there's been a few times in the last few days that it sounded tempting. But I have been thoroughly whipped by this respiratory infection. I'vebeen coughing almost constantly, my voice is pretty much shot (I barely made it through classes today), and I've been spiking fevers (I hit a hundred and one yesterday). So, it only took me a week to decide to see a doctor ( I see her at 4:30 today, and I'm looking forward to getting some quality drugs).

So why did I wait so long? Part of it was that I was hoping it would clear up on its own. Part of it was not wanting to take the time. But mostly because I'm a guy, dammit.

We are a stubborn and prideful bunch.

So why did I wait so long? Part of it was that I was hoping it would clear up on its own. Part of it was not wanting to take the time. But mostly because I'm a guy, dammit.

We are a stubborn and prideful bunch.

Thursday, February 01, 2007

Still Miserable

I'm still hacking away with the coughing. Luckily today's not a teaching day. But there's some prep work I have to get done for tomorrow's classes, and I have a head that feels like it's full of pudding (mmmmm - pudding...)

But at least tomorrow's classes will be done by noon and I can go back to sleep. I'm such a wuss when I get sick. Time to man up and get to work (so I can go home and pass out). In the meanwhile, here are a couple of links:

I'll reward myself for finishing my work with a bowl of miso soup. It's prepackaged, but at least it's warm.

But at least tomorrow's classes will be done by noon and I can go back to sleep. I'm such a wuss when I get sick. Time to man up and get to work (so I can go home and pass out). In the meanwhile, here are a couple of links:

Eleanor Laise at the WSJ reports on the proliferation different index fund choices.That's all I got. It's not much, but then I don't charge for the privelege, so I guess that's all right. Enjoy.

Mike Munger lists some poorly conceived website names. It's a must read - what were some of these folks thinking?

I'll reward myself for finishing my work with a bowl of miso soup. It's prepackaged, but at least it's warm.

Subscribe to:

Comments (Atom)