How was my day?

Well, I didn't get much research done, and I didn't get too much done on my classes either. I did meet with a student for about an hour while on a presentation that my class has to give to our outside advisory board.

But other than that, I didn't get much done. But I'm happy anyway.

Why? Because I just saved a bunch of money on my mortgage. I refinanced it from its initial 6.25% rate to a new rate of 5.75%. Total costs (once the escrow gets paid back in about a month) were about $1500. So, the decrease in the mortgage payment means I pay back costs in about a year, and after that I'm $1,500 to the good each year.

Not bad. The Unknown Wife and I are trying to save some money, but we celebrated by going out to the loval Java shop for a couple of good cups (Kona for her, a Latte for me) and an extremely rich pastry.

Yeah-- with two kids (and a still hefty, but less so after today mortgage), this is about as much as we end up splurging.

The finance classroom meets the outside world (and vice-versa). Back away slowly from the computer with your hands up and your mind open, and with luck nobody gets hurt.

Thursday, November 30, 2006

Wednesday, November 29, 2006

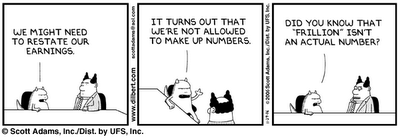

Earnings Restatements, Dilbert Style

Here's one for the "to use in class" file (from Dilbert.com website.)

And a tip-o-the-hat to The Big Picture for the link

And a tip-o-the-hat to The Big Picture for the link

The Unknown Son and Late-Stage Effects of Chemo (and a Link Dump, of course)

Today's a bit busy - I teach in the morning, and meet Unknown Wife immediately after so we can go to meet Unknown Son's new oncologist. He's in remission from his Neuroblastoma, so it's not a "serious" meeting. But he does have to issues to deal with.

Most chemotherapy works primarily by attacking ALL fast-growing cells, and he's had a lot of it. So, it often has implications for childhood growth. Unknown Wife and I are both on the smallish side, so we didn't expect U.S. to be a giant in any case. But he's by far the smallest in his class (most people guess him to be about 6 instead of 8, at least until he open his mouth). In addition, he probably has some slight neuropathy (nerve damage), which is a common side effect of pediatric chemo. Both U.W. and I have the reflexes of tree sloths, but U.S. is even more uncoordinated.

In any event, the new oncologist has specialized in late-stage effects of chemo. She actually did "write the book". So, we'll be consulting with her today to determine what options we have, or even if we need to be concerned.

Meanwhile, here's some stuff to keep you busy:

Most chemotherapy works primarily by attacking ALL fast-growing cells, and he's had a lot of it. So, it often has implications for childhood growth. Unknown Wife and I are both on the smallish side, so we didn't expect U.S. to be a giant in any case. But he's by far the smallest in his class (most people guess him to be about 6 instead of 8, at least until he open his mouth). In addition, he probably has some slight neuropathy (nerve damage), which is a common side effect of pediatric chemo. Both U.W. and I have the reflexes of tree sloths, but U.S. is even more uncoordinated.

In any event, the new oncologist has specialized in late-stage effects of chemo. She actually did "write the book". So, we'll be consulting with her today to determine what options we have, or even if we need to be concerned.

Meanwhile, here's some stuff to keep you busy:

CXO Advisory group has been going back and forth with Jim Cramer on his investment performance. I think they've gotten under his skin.Enough bloggery - back to work.

Theresa Lo is guest blogging at Alpha and Omega about "computer-replicated hedge funds". It seems that there are a couple of groups that are trying to do it on an automated basis that claim they can do it better than a flesh-and-blood manager.

Worthwhile Canadian Initiative has some good advice on how to present (or discuss) an academic paper.

John Prestbo at Marketwatch.com goes over the ins, outs, ups, and downs of hedge fund indexes. To quote Inigo Montoya, "I don't think that means what you think it means".

Tuesday, November 28, 2006

Slouching Toward The End Of The Semester

There's exactly two weeks (6 classes) left to the semester, and I have a little more than two chapters of material to cover. I actually have three chapters to cover, but since we're only taking parts of them, it works out to about 2 1/2 chapters. So, there's a bit of a time crunch. But there always seems to be at the end, so nothing new here.

I still have hopes of getting a paper out to a journal by the end of the semester. Stuff submitted just before the break always seems to take longer to get a referee report back on, but if I wait until we get back for the spring semester it'll be even longer. So I might as well punch it out and get it situated on some editor's desk (so he can get it on a reviewer's desk).

While I'm finishing up the edits, here are some links to keep y'all busy:

I still have hopes of getting a paper out to a journal by the end of the semester. Stuff submitted just before the break always seems to take longer to get a referee report back on, but if I wait until we get back for the spring semester it'll be even longer. So I might as well punch it out and get it situated on some editor's desk (so he can get it on a reviewer's desk).

While I'm finishing up the edits, here are some links to keep y'all busy:

The Wall Street Journal has a piece titled "The November Effect"that says that the stock prices of big winners (and losers) reverse course in November. I'm not aware of any academic research that shows this, but I'm more of a corporate guy. Still, it's interesting.Enough bloggery - back to work.

Matthew Goldstein of Thestreet.com is reporting on leveraged private-equity backed IPOs (or LIPOs, as they're commonly known). PE-backed IPOs accounted for 42% of all offereings this year, so they've become a significant part of the IPO market.

This week's Carnival of the Capitalists is up at Blueprint For Financial Prosperity. My pick of the week is the post by gongol.com that claims that responding to penny-stock internet spam may be unwittingly funding terrorism.

The Wall Street Journal online has a piece on Information networks.

It seems that there are now companies that pay industry "consultants" to gain superior information about the firms (or industries). Larry Ribstein says it's the inevitable consequence of Reg FD.

Eszter Hargittai gives a primer on how to send emails to academics correctly. If you're a reporter or someone trying to get help from one of my tribe read it - it's got some very good info.

Marketwatch.com reports on "Fundamental etf's" - ETFs that base portfolio wieghts not on market cap, but on factors like sales, market-book, market share, and so on.

Friday, November 24, 2006

A Good Thanksgiving For The Unknown Family- Now Back To Work

After a short (about 90 minute) drive, we had a great Thanksgiving at the house of the Unknown Sister-in-law. In addition to us, there were Unknown Wife's two sisters (both with spouses and two children), Unknown Grandparents, and our neighbor from when we lived in the MidWest who now lives about an hour away (we moved halfway across the country, and so did she). Good food, conversation, and fun was had by all. Here's hoping your Thanksgiving went as well. One of the more touching moments was when Unknown Son gave the blessing for the food and prayed for his cousin, who also has Neuroblastoma (he actually had it before Unknown Son and went into remission before U.S. was diagnosed, Then last year, the canvcer came back for his cousin).

Then last night, Unknown Wife and Kids took advantage of the opportunity to stay with Unknown Sister-In-Law and her family (we'd planned it earlier this week). So, I drove back, got an early night's sleep, and will work on research and classes until Saturday and their return (it's the end of the semester, so everything gets backed up).

In the meanwhile, here are a few links for your reading pleasure:

Then last night, Unknown Wife and Kids took advantage of the opportunity to stay with Unknown Sister-In-Law and her family (we'd planned it earlier this week). So, I drove back, got an early night's sleep, and will work on research and classes until Saturday and their return (it's the end of the semester, so everything gets backed up).

In the meanwhile, here are a few links for your reading pleasure:

Abnormal Returns has done a very nice piece on the Five C's of Private Equity Buyouts. It discusses some of the factors that have led to the growth of PE as a major force in the market. They areFinally, here's a quote by J.R.R. Tolkien to think about for the remainder of the day: "I don't know half of you half as well as I should like; and I like less than half of you half as well as you deserve."Now back to work!Read the whole thing here, and a follow up piece here.

- Capital

- Credit

- Complexity

- Control

- Congress

Jim Mahar at FinanceProfessor.com links to a piece by Brav, Graham, Harvey, and Michaely on payout (i.e. dividned and repurchase) policy. Anyone teaching advanced corporate finance should read it and give it to their class. It's another of Graham's great survey pieces, and shows what managers actually do (and what a surprise: sometimes it's different from what finance textbooks say they should do). And if you want to read more of Graham's research, click here. He also has a good survey piece that covers a broader range of topics in general corporate finance,

In addition, CXO Advisory Group discusses a piece by Lyandres, Sun and Zhang, titled "The New Issues Puzzle: Testing the Investment-Based Explanation". It argues that corporate investments patterns should be included when constructing benchmark returns (because issuing firms invest more than non-issuers). Once they do, much of the long-term underperformance for these firjms dissappears.

Wednesday, November 22, 2006

It's Always Christmas Time For Visa (video)

I'm usually not a fan of more legislation, but this one even I have a hard time being against.

One of my readers sent this link to Consumer's Union (the non-profit publisher of Consumer Reports). They're trying to encourage legislators to make credit card disclosures more transparent, and to rein in some of the more abusive credit card company practices.

They've got a great short animated video titled "It's Always Christmas Time For Visa". Check it out.

Then sign the petition, if you're so inclined.

One of my readers sent this link to Consumer's Union (the non-profit publisher of Consumer Reports). They're trying to encourage legislators to make credit card disclosures more transparent, and to rein in some of the more abusive credit card company practices.

They've got a great short animated video titled "It's Always Christmas Time For Visa". Check it out.

Then sign the petition, if you're so inclined.

Tuesday, November 21, 2006

It's a Research Day

It's a research day today. I have an exam tonight (and an alternate one earlier for those students who can't or don't want to take it tonight), so there's no teaching on the table today (except for the last-minute tide of panicked students who'll show up at my office). So, since I'm going in a bit later, I thought I'd put something up on the blog.

On today's research menu:

On today's research menu:

- I have to get data to a student at my former school (I sit on her dissertation committee). As I mentioned before, she knew I was coming here, so she chose her topic to take advantage of the new resources I'd have access to (pretty smart on her part). So, I'll pull some of the data from the big Hansen data set and send it to her.

- I'm still editing a paper that my coaters have send me. One knows the literature in the area phenomenally well (she's written a book), and the other's doing the empirical part. But I'm the only one who speaks (and writes) English as a cradle language. So I get to be the editor. They've actually written a very good first draft (as far as the basic story), but it needs polishing. So, I get to be what I call the "grammar & word nerd". I never thought I'd get so much mileage out of having my writing terrorized by nuns in my formative years.

- Finally, I'm pulling data for another project. It involves merging data together from three different databases and then sending it off to my coauthors for further torture. We got the idea at a recent conference when the three of us had a few beers one night - they were colleagues of a classmate of mine, and I knew them only in passing. But that's the great thing about conferences (and having a few beers) - you start talking and the ideas start flowing. And before you know it, you have a new research project.

Corporate Dealmaker highlights a study by investment bank Houlihan Lokey.Enough bloggery - it's time to head in to the office and get some research done. I've got data (and the English language) to torture!

The study finds that termination fees in mergers are slightly lower than they were in previous years. If it's a continuing trend (and not driven by a few data points), it might make for a good research topic -- it could have a lot of implications for the corporate control market.

Everyone's Illusion (a relatively new blog that looks like it's worth checking out) has a great, short post on hedge funds, tail risk, and loss aversion.

This week's Carnival of The Capitalists is up at Gongol. Posts of note include The Big Picture with links to the most influential of Milton Friedman's works

and James Hamilton of Econbrowser on how the yield curve indicates slower growth ahead but less chance of a recession.

Real Returns reports on a recent trend - share buybacks are increasing. He makes a good point-- that buybacks increase EPS even if earnings are flat.

The NY Times has an interesting piece titled Rewriting the Rules for Buyouts. It notes that minority shareholders don't share much in the gains to MBOs. However, one reason for the unequal sharing is that the managers in an MBO take on a great deal of risk. So, they might just be getting compensation for that risk. The article suggests some "cures", but I'm not sure they wouldn't do more harm than good. HT: Jim Mahar at FinanceProfessor.com.

Monday, November 20, 2006

When Will I Learn?

I was grading problem sets last night, and I thought, "Man - A Mike's Lemonade would go down pretty well right now". After all, I'd put in several hours of raking leaves (no, they're not done yet, but I have managed to give myself tendinitis in my wrist), spent a couple of hours editing a paper, and the kids were in bed.

And before I go further, I didn't have more than one.

But for some reason, any alcohol in the hour or two before bed messes up my sleep cycle. And I know this from experience. So I woke up at 3:00, and tossed and turned for the next 3 1/2 hours. Of course, today is my long teaching day.

Tomorrow is a research day. I've got a data set I have toget together for a student at my previous school who's working on her dissertation (I'm on her committee). We have the data she needs here at Unknown University version 2.0, but not at U.U. version 1.0 (in fact, since we knew I was coming here, the knowledge that I'd have access to the data was a major determinant in her choosing the topic). So, I'll make a cut of the data set and send it to her and she takes it from there.

I've also got an exam to give at 6:30, and the early version of the same at 3:00. So I'll be around all day (and evening).

In other words, I'll need breaks. So I'll post more tomorrow. For now, I'm going to bed.

Without Lemonade.

And before I go further, I didn't have more than one.

But for some reason, any alcohol in the hour or two before bed messes up my sleep cycle. And I know this from experience. So I woke up at 3:00, and tossed and turned for the next 3 1/2 hours. Of course, today is my long teaching day.

Tomorrow is a research day. I've got a data set I have toget together for a student at my previous school who's working on her dissertation (I'm on her committee). We have the data she needs here at Unknown University version 2.0, but not at U.U. version 1.0 (in fact, since we knew I was coming here, the knowledge that I'd have access to the data was a major determinant in her choosing the topic). So, I'll make a cut of the data set and send it to her and she takes it from there.

I've also got an exam to give at 6:30, and the early version of the same at 3:00. So I'll be around all day (and evening).

In other words, I'll need breaks. So I'll post more tomorrow. For now, I'm going to bed.

Without Lemonade.

Friday, November 17, 2006

TGIF Link Dump

It's the weekend at last. Well, not really, since I have enough work to make it necessary for me to come in to my office Satuday (and probably Sunday, too). But at least classes are done. And next week I have an exam in one class and a review in the other. And then Thanksgiving.

Hopefully, the light schedule for next week will allow me to catch up a bit. The first semester at a new school is always a bit hectic, and this one certainly ran true to form.

In any event, here are today's links:

Hopefully, the light schedule for next week will allow me to catch up a bit. The first semester at a new school is always a bit hectic, and this one certainly ran true to form.

In any event, here are today's links:

CXO Advisory group reviews some academic research on "synthetic hedge funds"Enough blogging. Back to research or no soup for you!

JLP at AllFinancialMatters has a short tutorial on how to get refreshable stock quotes in an Excell spreadsheet.

The traditional hedge fund compensation is "2 and 20" (i.e. a 2% annual fee of aasets under management and 20% of the profits). The NY Times Online reports on a hedge fund that has a very different compensation structure-0 ti's based on performance over multi-year windows.

The NYT also has another article where they profile a paper by Bebchuck, Grinstein, and Peyer. It indicates that options backdating wasn't just limited to high-tech firms. there was also a lot of it going on at old-line companies. HT: Jim Mahar at Financeprofessor.com.

Thursday, November 16, 2006

Milton Friedman RIP

Nobel Laureate Milton Friedman passed away last night at age 94. He was truly one of the great champions of of our times for both personal and economic freedom. Here's a good piece his obitiuary in the Financial Times:

Read the whole thing here --it gives a very detailed account of his life and work.

We're definitely the poorer for his passing.

Both his admirers and his detractors have pointed out that his world view was essentially simple: a passionate belief in personal freedom combined with a conviction that free markets were the best way of co-ordinating the activities of dispersed individuals to their mutual enrichment. Where he shone was in his ability to derive interesting and unexpected consequences from simple ideas. As I knew from my postbag, part of his appeal lay in his willingness to come out with home truths which had occurred to many other people who had not dared to utter them. Friedman would then go on, however, to defend these maxims against the massed forces of economic correctness; and in the course of those defences he, almost unintentionally, added to knowledge.

We're definitely the poorer for his passing.

Wednesday, November 15, 2006

Wednesday Link Dump

I'm done teaching for the day, but still in the midst of rewriting a paper. So, without further ado, here are some links for your viewing pleasure:

However, if you want more things to read, go amuse yourself with Scott Adams' blog (yes- the creator of Dilbert has a blog). He's even funnier on the blog than in his cartoons.

The SEC has released a new and improved search tool for EDGAR (the online repository for company filings). HT: Jack Ciesielski at AAO Weblog for the pointer.Hopefully, I'll have more to say later.

Know a concept but can't think of the word for it? Here's a handyreverse dictionary from onelook.com to help you out.

A couple of days ago, I linked to a paper that claimed the IBES had subsequently anonymized analyst forecasts. According to Thomson, the matter's been resolved, and the paper's been withdrawn.

Marshall Loeb of Marketwatch.com explains why cancelling your credit card might not always help your credit score.

Joe Carter at Evangelical Outpost has the latest installment in his Yak Shaving Razor series.

However, if you want more things to read, go amuse yourself with Scott Adams' blog (yes- the creator of Dilbert has a blog). He's even funnier on the blog than in his cartoons.

Tuesday, November 14, 2006

Tuesday Link Dump

No teaching today, so it's time to catch up - there are quizzes to grade and solutions to a problem set to type up for the students. I post the worked out solutions to my problem sets on the web after the problem set has been collected so students see where they went astray in the assignment (and it saves time in class - they can see digest the solutions on their own time rather than me having to blow a whole class period working through them).

And last but not least, I have RESEARCH to do. I've got a paper to carve up and rewrite. The initial draft of the paper was written by my colleagues -- a very good theorist, and a very young but promising empiricist. But the other two "ain't from around these parts". So, since I'm the only one who speaks (and writes) English as a first language, I get to be the writer/editor. Luckily, I like editing.

It's even more interesting, since our study extends some seminal work by someone who's likely to be the referee. So I have to be vewwy, vewwy careful to be complimentary of his contributions (after all, while I'm not hunting Wabbits, I AM hunting publications). Ah well, that's what Chapstick is for.

So, here are some links to keep you busy while I try to be productive:

And last but not least, I have RESEARCH to do. I've got a paper to carve up and rewrite. The initial draft of the paper was written by my colleagues -- a very good theorist, and a very young but promising empiricist. But the other two "ain't from around these parts". So, since I'm the only one who speaks (and writes) English as a first language, I get to be the writer/editor. Luckily, I like editing.

It's even more interesting, since our study extends some seminal work by someone who's likely to be the referee. So I have to be vewwy, vewwy careful to be complimentary of his contributions (after all, while I'm not hunting Wabbits, I AM hunting publications). Ah well, that's what Chapstick is for.

So, here are some links to keep you busy while I try to be productive:

Stockpickr has a list of the Top 100 Business Blogs (and no, FR isn't on it - sniff!).Back to work -- I don't have tenure yet!

CFO.com discusses some issues related to spreadsheet security.

What should you call the payouts an executive receives following a merger? Footnoted.org has some examples from recent mergers.

Banks are talking about developing "Death derivatives". If they can get the right data, it could potentially provide pension funds another tool for hedging mortality risk.

Finally, for the "inside baseball" post of the day, it looks like discrimination in higher education is still around. But now it's against Asian American Students. After all, it wouldn't be fair to make admissions decisions strictly based on merits now, would it?

Monday, November 13, 2006

Monday Link Dump

Monday is my main teaching day, and I have a lot to prepare before my evening class. So, blogging might be sparse. In fact, I only have three links for you today. Here they are:

This week's Carnival of The Capitalists is hosted at Casey Software. My favorite piece of the week was Undoing Roth IRA Contribution Mistakes from Fivecentnickel.com.I may blog later today, but I feel a low-pressure system and lack of sleep migraine coming on. So probably not.

Richard Kang at SeekingAlpha.com tells us about some new leveraged ETFs from Rydex they seek to provide double the return of an index, the inverse of the index's return, and double the inverse of the index's return. They'll be linked to various equity indexes.

Finally, Mary Mckinney at Academic Coach is talking about the benefits of using an editor.

Sunday, November 12, 2006

Thoughts On A High School Reunion

We survived my 30th reunion. It was held in my hometown in a fairly low-rent place- a social club known as the Italian Benefit Society (or, as it's now called, The Italian Club). Since I grew up in an Italian immigrant mill town, it used to be the center of social life for the town - it had a bar, picnic tables, a horseshoe pit, and two rolled-clay bocce courts. Now, since the old guard (my father's generation) have all passed away, it's mainly a bar.

Since the 30th isn't such a big deal, there were only about 30 of my classmates there (out of about 145 graduates). Most of the people there were either those who never left my small town or the group who held all the class offices, played on the teams, and so on.

The first group was kind of sad, and mostly got very, very drunk. The second, however, had lived pretty interesting lives (they'd left town, gone to college, and then moved back to nearby towns). One had cycled from New England to Anchorage, Alaska, another had lived on an Indian Reservation and was now a priest, and another had crewed a sailboat to South America and now taught Social Studies in a rural part of the state. The classmate we shared a table with was a pretty quiet guy in high school that mostly partied and barely made it through. After spinning his wheels for a bit, he ended first going to a community college and ended up with an engineering degree. He and his family (he married his high school sweetheart) visit a new major league baseball stadium each summer.

So all in all, it was a pretty good weekend.

We got back this afternoon (we stayed at my mom's place last night). So, since I've pretty much finished my preparation for the week (I still have to put the finishing touches on a quiz for tomorrow, but that shouldn't take long), it's time to veg out a bit.

Since the 30th isn't such a big deal, there were only about 30 of my classmates there (out of about 145 graduates). Most of the people there were either those who never left my small town or the group who held all the class offices, played on the teams, and so on.

The first group was kind of sad, and mostly got very, very drunk. The second, however, had lived pretty interesting lives (they'd left town, gone to college, and then moved back to nearby towns). One had cycled from New England to Anchorage, Alaska, another had lived on an Indian Reservation and was now a priest, and another had crewed a sailboat to South America and now taught Social Studies in a rural part of the state. The classmate we shared a table with was a pretty quiet guy in high school that mostly partied and barely made it through. After spinning his wheels for a bit, he ended first going to a community college and ended up with an engineering degree. He and his family (he married his high school sweetheart) visit a new major league baseball stadium each summer.

So all in all, it was a pretty good weekend.

We got back this afternoon (we stayed at my mom's place last night). So, since I've pretty much finished my preparation for the week (I still have to put the finishing touches on a quiz for tomorrow, but that shouldn't take long), it's time to veg out a bit.

Saturday, November 11, 2006

Saturday Link Dump

The Princess (a.k.a. The Unknown Daughter) turned six on Thursday. We had a small family celebration that night, but she has her friends over for the big to-do today. That means that in a short while there'll be 10 little girls in the house having a tea party, decorating cookies, and otherwise causing a merry commotion.

This afternoon, Unknown Son has a soccer game, and later this afternoon we drive about 90 minutes to Unknown Grandma's house (incidentally, we do cross a river and go through a wooded area). She'll watch them for the evening while we go to my 30th high-school reunion.

So, since later blogging is unlikely, here are today's links:

This afternoon, Unknown Son has a soccer game, and later this afternoon we drive about 90 minutes to Unknown Grandma's house (incidentally, we do cross a river and go through a wooded area). She'll watch them for the evening while we go to my 30th high-school reunion.

So, since later blogging is unlikely, here are today's links:

According to the Wall Street Journal, political junkies are trading in political futures markets like Tradesports.That's all for today, folks. I have a few errands to run before we get overrun by little girls.

The NY Times reports on how companies targeted by hedge fund short-sellers are starting to fight back using the courts.

About Economics has a good primer on Foreign Exchange Rates and FX Markets.

I won't even describe this stunt except to say Do. Not. Try. This. HT: The very strange lads at Catallarchy.

Lisa Fairfax at The Conglomerate discusses a recent study by TIAA-CREF that indicates that having women on corporate boards changes governance dynamics.

James Hamilton at Econbrowser has studied the effects of Fed interest rate changes on the housing market. He finds that an interest rate change affects new home sales for up to five months later.

Wednesday, November 08, 2006

Revisionist Revisions at IBES!

Like many academics in the fields of finance and accounting, I regularly use the IBES (Institutional Brokers Estimate System) database of analyst forecasts (compiled by Thomson) in my research. So this next piece troubled me. It seems like restatements are not just limited to companies - IBES makes them too!

Ljungqvist, Malloy, and Marston have done a very interesting study of IBES forecasts titled Rewriting History. They find that the some "bad" analysts reports on IBES are subsequently removed from the database in later versions:

It's reminiscent of the old Soviet style of rewriting history to suit current needs. In retrospect (no pun intended), it doesn't surprise me that this could happen. But it does make Thomson look pretty bad. It also might add some biases to the data that might make researchers less likely to trust results derived from this data.

I know it's got me thinking about how this affects my current IBES-based project.

HT: The New Economist

Update: I just received an email from a representative of Thomson (the company that puts IBES together). In the interest of fairness, I thought I'd post it here:

I'm agnostic about the whole business, but time will tell which story holds more water.

But I must say, I'm impressed that the Thomson p.r. department understands enough about reputation and the internet to monitor the blogosphere.

Ljungqvist, Malloy, and Marston have done a very interesting study of IBES forecasts titled Rewriting History. They find that the some "bad" analysts reports on IBES are subsequently removed from the database in later versions:

Comparing two snapshots of the entire I/B/E/S analyst stock recommendations database, taken in 2002 and 2004 but each covering the same time period 1993-2002, we identify nearly twenty thousand changes of an unusual nature: the selective removal of analyst names from historic recommendations ("“anonymizations"”). This practice turns out to be pervasive and non-random: Bolder recommendations are more likely to be anonymized, as are recommendations from more senior analysts, Institutional Investor "“all-stars,"” and those who remain in the industry beyond 2002. Abnormal stock returns following subsequently anonymized buy recommendations are significantly lower (by up to 11.0% p.a.) than those following buy recommendations that remain untouched, suggesting that particularly embarrassing recommendations are most likely to be anonymized. Analysts whose track records appear brighter due to anonymizations experience more favorable career outcomes over the 2003-2005 period than their track records and abilities would otherwise warrant.

I know it's got me thinking about how this affects my current IBES-based project.

HT: The New Economist

Update: I just received an email from a representative of Thomson (the company that puts IBES together). In the interest of fairness, I thought I'd post it here:

“The conclusions of the report are wrong. The integrity of Thomson Financial’s I/B/E/S database is without question and all analyst ID’s and their recommendations are maintained in the master I/B/E/S database. This particular report was based on an incomplete data set. The analyst data in question was however, available in other subfiles, which were accessible to the researchers. While we are disappointed the report was issued as is, we have reached out to the authors to ensure they both understand the data and alternate mechanisms to access the data they were originally looking for.”

But I must say, I'm impressed that the Thomson p.r. department understands enough about reputation and the internet to monitor the blogosphere.

Tuesday, November 07, 2006

Wednesday Link Dump

It's post-election hangover time, and it looks like the Democrats have taken the House (and possibly the Senate). So it's back to work. Here are today's links:

All it took was Tom Cruise, and Going Private is back! Once again EquityPrivate is talking about "Vegetable Capital". And it doesn't refer to this.And now, it's time to do some research ( Maybe on IBES data...).

There are a couple of Carnivals to go to. City Girl is hosting The Carnival of Personal Finance (my personal favorite is 10 Ways To Save On Beer (with beer calculator ). And the Carnival of the Capitalists is up at Gill blog. Make sure to check out Dan Melson's post on Sellers Lending to Buyers and Selling the Note and Sox First on accountants pushing to get government protection from shareholders who might want to sue them for doing bad audits.

EconLog highlights research by Hausman on WalMart. He finds that Walmart is good for economic efficiency - it cuts suppliers' margins and passes the savings along to customers, thereby driving producers closer to marginal costs. And it benefits the poor more than the rich.

I learned about another financial instrument today The Financial Times discusses the how and why of CPDOs (Constant Proportion Debt Obligations). The new products and strategies created by financial engineers never cease to amaze me.

And for a chuckle, Dan Melson at Searchlight Crusade links to a way of dealing with telemarketers I wish I'd though of.

Prediction Markets and Elections - Updated

I'm a big fan of prediction markets. They're a very good way of illustrating how markets impound information into prices.

Since today is election day, I thought I'd put a link up to Tradesports. For those of you who've never heard of it, Tradesports runs a futures market that allows you to bet on various events. Since the contract pays $1 if the event occurs, some fairly basic algebra shows that its fair price is essentially the probability that the event will occur.

To illustrate this, let's look at the contracts for Republican Control of the House and Senate. They're trading at $0.17 and $0.698 at the time of this posting. This implies that the traders in these markets currently assess the probability of Republicans retaining control of the House at 17% and of the Senate at 69.8%.

To see how information affects the contracts' prices, assume a trader had information that led him to believe that the chance of Republicans retaining House control was actually much higher than 17% (let's say 45%, for example). If so, he'd consider the current price a real bargain, and would start buying contracts. This would drive the price up until his information was fully reflected in the price.

Like I've said before, they're not a perfect predictor. But I do trust them much more than polls. I have several friends who make it a point to answer incorrectly whenever a pollster calls -- just so the polls will be less useful. Granted, I have a pretty contrarian bunch of friends, but I doubt they're alone.

In contract, in a prrediction market, the traders' own personal ideologies wouldn't matter - if they thought the probabilities were off, they'd trade in the contracts to make money.

Any one trader could be wrong. But if there are enough players in the market, the prices would be pretty good aggregators of everyone's info.

So check into Tradesports throughout the day, and see how the prices (and hence, the probabilities) change.

Updated 11/8: As of 10:15 a.m., Tradesports gave the Republicans between a 10.5% and 12.5% chance of retaining control in the Senate (obviously, trading in the House Control contract has closed).

Since today is election day, I thought I'd put a link up to Tradesports. For those of you who've never heard of it, Tradesports runs a futures market that allows you to bet on various events. Since the contract pays $1 if the event occurs, some fairly basic algebra shows that its fair price is essentially the probability that the event will occur.

To illustrate this, let's look at the contracts for Republican Control of the House and Senate. They're trading at $0.17 and $0.698 at the time of this posting. This implies that the traders in these markets currently assess the probability of Republicans retaining control of the House at 17% and of the Senate at 69.8%.

To see how information affects the contracts' prices, assume a trader had information that led him to believe that the chance of Republicans retaining House control was actually much higher than 17% (let's say 45%, for example). If so, he'd consider the current price a real bargain, and would start buying contracts. This would drive the price up until his information was fully reflected in the price.

Like I've said before, they're not a perfect predictor. But I do trust them much more than polls. I have several friends who make it a point to answer incorrectly whenever a pollster calls -- just so the polls will be less useful. Granted, I have a pretty contrarian bunch of friends, but I doubt they're alone.

In contract, in a prrediction market, the traders' own personal ideologies wouldn't matter - if they thought the probabilities were off, they'd trade in the contracts to make money.

Any one trader could be wrong. But if there are enough players in the market, the prices would be pretty good aggregators of everyone's info.

So check into Tradesports throughout the day, and see how the prices (and hence, the probabilities) change.

Updated 11/8: As of 10:15 a.m., Tradesports gave the Republicans between a 10.5% and 12.5% chance of retaining control in the Senate (obviously, trading in the House Control contract has closed).

Tuesday Link Dump

Since I'm teaching on a MWF schedule this fall, today is an off off day - no teaching. But tomorrow is also an off day. Unknown University has a very interesting approach to calendars and the days of the week. Since today is election day, we have it off (somebody must have done a great job in negotiating - we get days off for alomost every conceivable holiday, and a few that aren't).

But, it gets even stranger - since classes on Tuesday were skipped, tomorrow (which is Wednesday anywhere else) becomes Tuedsay and Wednesday disappears into some academic black hole. Other times, if we have a Monday off, Tuesday becomes Monday. It has something to do with making sure all days meet an equal amount of time, but it does get a bit surreal at times.

So, without further calendarial confusion, here's the Tuesday (or whatever it is this week) Link Dump:

But, it gets even stranger - since classes on Tuesday were skipped, tomorrow (which is Wednesday anywhere else) becomes Tuedsay and Wednesday disappears into some academic black hole. Other times, if we have a Monday off, Tuesday becomes Monday. It has something to do with making sure all days meet an equal amount of time, but it does get a bit surreal at times.

So, without further calendarial confusion, here's the Tuesday (or whatever it is this week) Link Dump:

In addition to being one of the smartest economists around, Kevin Murphy of the U of Chicago also had one of the more unusual goals in life - to be the "world's best coauthor." He's done that HT: Marginal RevolutionBack to the world of research. I'll get back to teaching stuff on Wednesday (er, ah, Tuesday. Or whatever they call it this week).

Barry Rehfeld of the NY Times online discusses the Long-term investment performance of spinoffs

Craig Newmark links to a list of 50 Things for professors to do on the first day of class. Maybe next semester.

Since I just linked to an interview of Eugene Fama yesterday, it's only fitting that I link today to a Wall Street Journal Article on Dimesionsl Fund Advisors. It's run by former Fama students who use a lot of his work, and Fama sits on the board.

There's a story in Marketwatch.com about a new search engine called Powerset. It's not publicly available yet, but it sounds very interesting - it allows "natural language" queries and seems to understand the context of a question.

Friday, November 03, 2006

Eugene Fama Speaks

It's the start of a new week at Unknown University. And what better way to get it started off right than with an interview of one of the "founding fathers" of modern finance, Eugene Fama . His dissertation (published whole in the Journal of Business in 1965) set the groundwork for the modern version of the theory of efficient markets, and he's played a big part in many of its subsequent developments.

Click here to read an interview of Fama by Nina Mehtais in Financial Engineeering News.

Fama does a great job of explaining the way the development of the CAPM affected the discussion of market efficiency:

Click here to read an interview of Fama by Nina Mehtais in Financial Engineeering News.

Fama does a great job of explaining the way the development of the CAPM affected the discussion of market efficiency:

There's much, much more in the article. Read the whole thing -- it's short, and well worth it.Nobody realized before that if the market was working properly, you had to say something about what the market was doing in setting prices in terms of the relation between expected return and risk. Something like the Capital Asset Pricing Model was necessary before you could really test market efficiency. If you look back, you can see primitive statements about expected returns that were built into tests people were doing. But they didn’t realize they were making these statements.FEN: What are you referring to?

EF: If you say autocorrelations must be close to zero, what you’re really saying is that expected returns are constant, so that’s a statement about equilibrium right there.

TGIF Link Dump

Yes, it's Friday at Unknown University (and everywhere else, for that matter). I've taught my classes, graded my exams, and even done a little research.

Unfortunately, I also had to fill out faculty evaluation forms for other faculty. Yes, that's right -- at Unknown University, ALL college members get to chime in on ALL tenure and promotion cases.

So, we end up in the ridiculous situation of a brand new untenured assistant professor filling out an evaluation of whether or not an Associate should be promoted to Full. And better yet - the associate professor can ask to see the untenured assistant professor's evaluations (after the fact, but still, it's a possibility).

Since I'm brand new, I decided not to fill out evaluations for anyone but the two assistant professors in my area that are going up for tenure, and a couple of other assistant professors who have regular annual reviews (I know their work, so it's pretty easy). Both should be shoo-ins for tenure, but stranger things have happened. As for the others, if I'm challenged for not having filled out an evaluation, I'll just say that I'm not comfortable with my ability to make a decision that carries so much importance.

In any event, here are some links to keep y'all busy while I go out for a Strongbow's Cider ( or two) with some colleagues (who aren't up for either tenure or full):

Unfortunately, I also had to fill out faculty evaluation forms for other faculty. Yes, that's right -- at Unknown University, ALL college members get to chime in on ALL tenure and promotion cases.

So, we end up in the ridiculous situation of a brand new untenured assistant professor filling out an evaluation of whether or not an Associate should be promoted to Full. And better yet - the associate professor can ask to see the untenured assistant professor's evaluations (after the fact, but still, it's a possibility).

Since I'm brand new, I decided not to fill out evaluations for anyone but the two assistant professors in my area that are going up for tenure, and a couple of other assistant professors who have regular annual reviews (I know their work, so it's pretty easy). Both should be shoo-ins for tenure, but stranger things have happened. As for the others, if I'm challenged for not having filled out an evaluation, I'll just say that I'm not comfortable with my ability to make a decision that carries so much importance.

In any event, here are some links to keep y'all busy while I go out for a Strongbow's Cider ( or two) with some colleagues (who aren't up for either tenure or full):

Ever wonder what GDP, CPI, and all those other acronyms mean? About Economis has a good primer on economic indicators.Enough blogging - pass the StrongBows.

The scheduled host of the Carnival of the Capitalists screwed up. So, the fine folks who run the Carnival have posted it here.

And last but not least, Seeking Alpha discusses ETFs with 12b-1 fees. Now THAT's an investment to avoid.

Thursday, November 02, 2006

ETFs That Don't Follow Indexes

Tuesday's Wall Street Journal carried a piece titled ETFs Redefine What is An 'Index', which reported on a new trend in ETFs. The first ETFs tracked known market benchmarks, like the S&P 500 or the Dow Jones average. However, since most of the well known indexes are taken, Amex has started offering ETFs that track "rules based portfolios".

What's a rule based portfolio? It's a portfolio constructed based on some rule, or algorithm. An example might be "the stocks in the lowest decile of Earnings-price ratios" or "all mid cap stocks that have had 5 years of greater than 10% annual revenue growth".

So what's the difference between a "rule based portfolio and an actively managed one? I can't see one, but the proponents of these funds say that the algorithm will be executed entirely by computer, so there's no human judgement or discretion involved.

It's an interesting concept, and one that might spark a lot of classroom discussion. Here are a few questions I'll be asking my investments class:

1) What's the difference between a rule-based ETF and an actively managed mutual fund?

2) What role might these funds play in an investment portfolio?

3) If these ETFs become more popular (and I bet they will), how will it change the nature of the investment process (for either individuals or professional money managers)?

4) Will these ETFs eliminate the need for security analysis?

As I said, interesting stuff. And they pay me to do this. Amazing.

What's a rule based portfolio? It's a portfolio constructed based on some rule, or algorithm. An example might be "the stocks in the lowest decile of Earnings-price ratios" or "all mid cap stocks that have had 5 years of greater than 10% annual revenue growth".

So what's the difference between a "rule based portfolio and an actively managed one? I can't see one, but the proponents of these funds say that the algorithm will be executed entirely by computer, so there's no human judgement or discretion involved.

It's an interesting concept, and one that might spark a lot of classroom discussion. Here are a few questions I'll be asking my investments class:

1) What's the difference between a rule-based ETF and an actively managed mutual fund?

2) What role might these funds play in an investment portfolio?

3) If these ETFs become more popular (and I bet they will), how will it change the nature of the investment process (for either individuals or professional money managers)?

4) Will these ETFs eliminate the need for security analysis?

As I said, interesting stuff. And they pay me to do this. Amazing.

Subscribe to:

Comments (Atom)